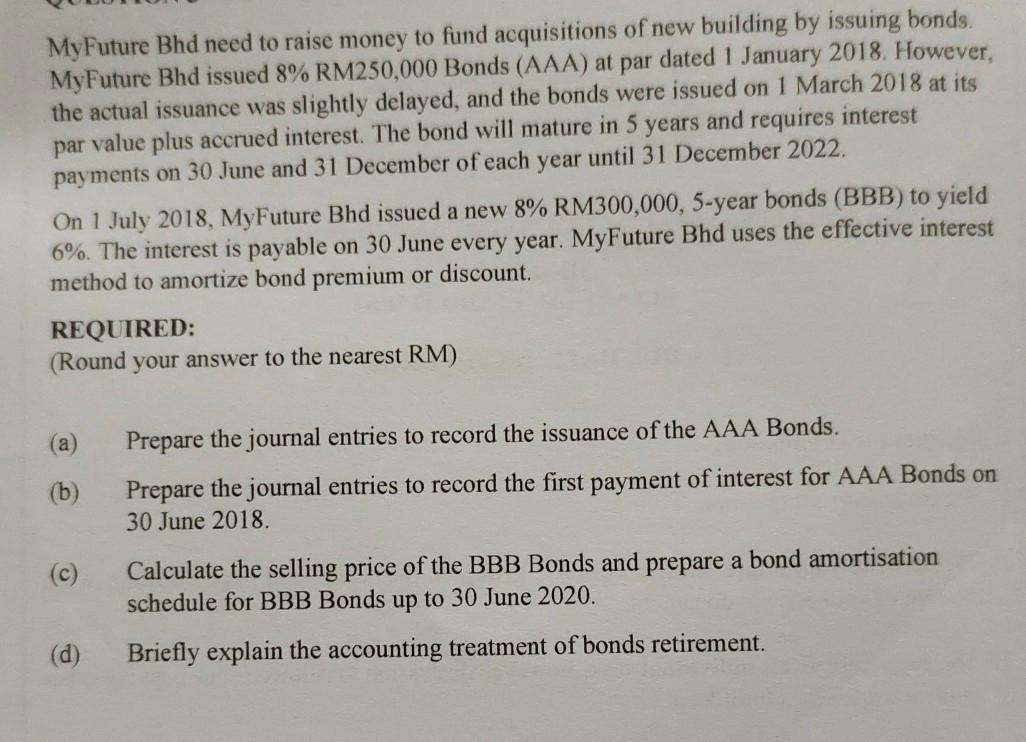

MyFuture Bhd need to raise money to fund acquisitions of new building by issuing bonds. MyFuture Bhd issued 8% RM250,000 Bonds (AAA) at par dated 1 January 2018. However, the actual issuance was slightly delayed, and the bonds were issued on 1 March 2018 at its par value plus accrued interest. The bond will mature in 5 years and requires interest payments on 30 June and 31 December of each year until 31 December 2022. On 1 July 2018, MyFuture Bhd issued a new 8% RM300,000, 5-year bonds (BBB) to yield 6%. The interest is payable on 30 June every year. MyFuture Bhd uses the effective interest method to amortize bond premium or discount. REQUIRED: (Round your answer to the nearest RM) Prepare the journal entries to record the issuance of the AAA Bonds. (b) Prepare the journal entries to record the first payment of interest for AAA Bonds on 30 June 2018 (C) Calculate the selling price of the BBB Bonds and prepare a bond amortisation schedule for BBB Bonds up to 30 June 2020. (d) Briefly explain the accounting treatment of bonds retirement.

Link will be apear in 30 seconds.

Well done! you have successfully gained access to Decrypted Link.

Question:

Answer: